Overcoming Budgeting and Saving Challenges with the W.I.S.E. Budget Box

Financial success is two-pronged. You need to know what to do and then you have to do it. One, learn and two, take action.

You’ve learned that a budget is a cornerstone for achieving financial success. A budget is crucial for mastering your money to achieve the financial and time freedom you desire.

Acting on this knowledge is easier said than done at times.

Maybe budgeting is like a curse word for you or maybe you don’t mind it too much, but you need a better system for managing your money.

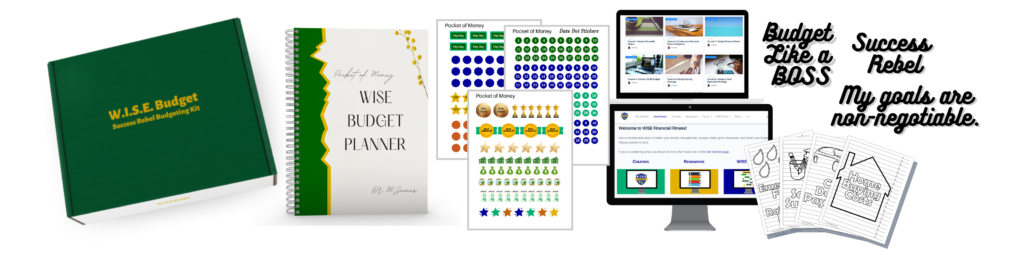

This is why I created my brand-new solution, the W.I.S.E. Budget Box. I want to remove the budgeting challenges that may be holding you back from financial success.

The W.I.S.E. Budget Box is a simple 90-day system to help you consistently

- do financial planning,

- successfully budget,

- save more money,

- and pay off debt.

Let’s discuss how it smashes some of the biggest budgeting challenges.

1) Keeping Track of Spending/Bills

The money calendars create a visual plan of money coming in and going out. The daily expenses trackers will help you stay on top of bills and spending. Keep track of everything in one place.

2) Overspending

Writing out your expenses will help you be mindful of the amount of money you are spending and curb overspending and online shopping. You’ll be able to see the balance for each budget category.

3) Saving Money

This is a big one right. Consistently planning and budgeting will help you save money and find more money to save. Consistently is the key word there. Also, the courses in WISE Financial Fitness (to which you will also have access) will help you discover ways to cut costs and not quality.

4) Multiple Saving Goals

In your saving strategy, manage and prioritize multiple savings goals to achieve your goals. It’s common to have multiple goals such as saving for a home or car down payment, engagement ring, wedding, and retirement at the same time. You’ll be able to make sure you’re maximizing your cash flow to achieve your savings goals.

5) Paying Off Debt

Stay organized and use a debt elimination method to knock out debt and stay debt free. The W.I.S.E. Budget Box can keep you organized and laser-focused with a 90-day system that continues throughout the year.

Learn more and secure a subscription by clicking the link below:

BRAND NEW: WISE Budget Box $57 (57% off $125.00)

Without the budget box, you would pay over $500 a year for all the physical and digital resources included in the subscription.

Instead, you can get everything shipped to you for free and achieve your financial goals for less than $20 per month.