Saving Money Habits and Wealth. How do Americans compare?

Saving money is crucial to building wealth as you’ll see below. However, many of us do very poorly with saving money. The statistics are really shocking. How does American saving money habits compare to others across the world? We’re getting completely crushed by individuals in other countries. Why does this matter? Find out below.

America

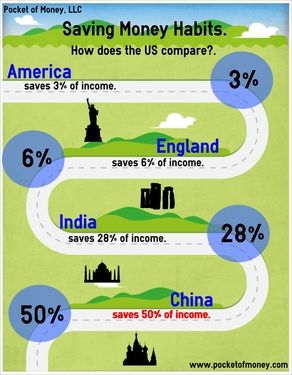

Although America is deemed one of the richest countries, many of us have horrible habits for saving money. A shocking 28% of American families do not have any money saved up, no financial cushion and 60% don’t have enough money saved to cover emergencies. Of the individuals who do save money, they save only three percent of their income. Let’s put that into perspective. An American person who makes $45,000 per year is only saving less than $2,000 if s/he’s saving anything at all.

England

What’s interesting, not surprising though, is we’re not alone in this. The British also share this horrendous habit. Amazingly, 70% of the British don’t have don’t have money saved for emergencies. Of those who do save money, they only save six percent of their income. This is not much better than us Americans. To put that into perspective, a Brit who makes the equivalent of $45,000 per year is only saving the equivalent of $2,700 of his/her income. Again, not much money saved at all.

Asia

The individuals in Asia and South Asia have us beat by a landslide. In China, people generally save 50% of their income. Maintaining the same example from above, a person making the equivalent of $45,000 per year would save $22,500 in one year. Wow, that’s amazing. Well amazing to us but normal for them. In India, the majority of people save approximately 28% of their income. A person in India making the equivalent $45,000 per year would save $12,600 of that throughout the year.

Why does this matter?

Why is the amount of money you’re saving important? There are several reasons why saving money is crucial to your financial well-being. Two key reasons are: acquiring items without borrowing money and building wealth. In order to acquire items or pay for things without going into debt you need money available after paying for needs such as shelter and food. Usually we don’t have enough money remaining at the end of the month in order to purchase items outright, over 40% of Americans live paycheck to paycheck. Therefore, we have to save money in order to purchase things outside of bills.

Common reasons that we need to save money include:

1) Emergencies. It’s necessary to be ready for that blown tire, cracked windshield that needs to be replaced, broken water heater, etc. Replacing and installing a tire can run over $100 and so can replacing a windshield. Replacing a broken water heater will cost a few hundred dollars easy. Having that money stored in an easily accessible form and place is important to avoiding the debt cycle. Saving money and building an emergency fund will allow you to handle those instances without borrowing money and creating debt.

2) Vacations. We all like to take or indulge in get-aways. They are great stress relievers and allow you to see other places and cultures. However, they only truly relieve stress if you you’re not creating mountains of debt in order to get away. There are many factors that affect the cost of a vacation, but it’s safe to say a vacation will cost a few hundred to a few thousand dollars. Most definitely do not have that just laying around.

3) Home improvement projects. Houses will need repair; it’s a fact of life and the passage of time. You may need to replace or fix the gutters, fix a plumbing problem, landscape the yard, replace the pool etc. Again these projects will cost another few hundred dollars or more per project.

Saving money and retirement

You should also be saving money for retirement and putting money aside in a retirement account. You will live at least 20 years after retirement (if you retire at age 65). What type of lifestyle do you want to have during those years? Do you want to have money to leave for the next generation? Would you like to travel to new countries, see the world?

If you would like to at minimum maintain your current lifestyle or live on a grander scale you need to have enough money saved to be able to live comfortably during retirement. You need to place enough money in a retirement account so that you can live off at least 8% of it per year. Hence, saving money is highly important to building wealth.

If you’re not saving money you’re cutting yourself out of thousands of dollars.

A last few words

I hope the last few examples have shown why it’s so important to save money and why as Americans we are in serious trouble in this area. We all experience a few of the examples listed above a year and should be saving for retirement. It’s very easy to create a reason why you “have to” spend the money instead of save it. Or you’re thinking about the fact that you live paycheck to paycheck now, how could you possibly put some money aside.

You can and you have to in order to build wealth. People survive and thrive on less than you’re making. If we go back to the example from above, if you’re making $45,000 there are people living on less. You probably know of individuals making $35,000 or $40,000 etc. You can live on less, you just need to cut costs. By cutting costs you will free up money that can be saved and used for necessary projects or leisure items, like that super special vacation you’ve always wanted to take.

How do you compare, how are your saving money habits? Were you shocked by the statistics? Leave your thoughts and comments below.