3 Steps to Paying Back Your Student Loans Faster

I mentioned my guest article published on Bobby Finance a few weeks ago and received a few questions about it so I’m posting it here to assist those with questions on student loans. I also want to add that you can also go to the site www.myfedloan.org to view and manage all your federal loans.

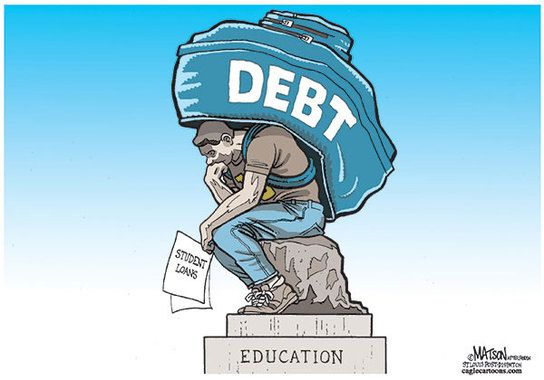

Many of us have taken out student loans to finance our education. If this is your case, you are probably very conscious of the large sum of money that you must repay after graduating. You may be anxiously wondering how to go about paying back your student loans. You probably have many questions like: where did you put the promissory notes and do you still need them? How do you figure out who to pay back and how much to pay them? How do you even go about paying the loans back?

I did ask all these questions as it came time to repay student loans: I couldn’t remember exactly how much I owed. I didn’t know who to contact to repay the loans. I also knew I wouldn’t be able to immediately start paying back what I owed, but I didn’t want to be one of those people hounded by calls from collectors. If you’re in this boat, here are three steps to get you started.

Step 1: Get a snapshot.

The first step is determining who you owe and how much you owe. Request your free annual copy of your credit report. The amount you owe and to whom will be listed.

If you have federal student loans, you can also log in to the US Department of Education’s National Student Loans Data System at the site www.nslds.ed.gov to get a snapshot of your federal student loans. Create a list that includes the lender, how much you owe, and how much time is left in your grace period if it hasn’t ended yet. The grace period is usually six to nine months.

Step 2: Determine if you need to defer or forbear.

If you are not in an economic position to repay your student loans upon graduating or your circumstances change, you can apply for deferment or forbearance. Deferment is when you can delay repayment of the loan and forbearance is when you are allowed to temporarily suspend or reduce your payments. For federal student loans you can check the site studentaid.ed.gov to determine if your particular situation allows for deferment or forbearance.

Generally, if you enroll in graduate school or are unemployed then you can defer your loans. You can apply for deferment at the site http://www.nslds.ed.gov. For private loans, check with the lender to determine if they offer deferment or forbearance and under which conditions you are eligible for each. You will also apply through the private lender.

Step 3: Prepare your own repayment plan.

Once you’ve determined the total amount of money you owe, who you owe, and when you will need to start making payments you can create your own plan to pay down the debt. Determine how much you will owe in loans per month. Make the minimum payments until you’re ready to aggressively pay them off (you have an emergency fund established and eliminated other debt).

Start paying more than the minimum payment on the loan with the smallest amount of money owed. Once that loan is paid off, start paying more than the minimum for the next smallest student loan. Continue this method until all your student loans are paid off.

Some argue that since student loans have a relatively low interest rate you shouldn’t aggressively pay them off. However, it’s generally better to pay off your student loans early and save money on the interest you will not have to pay in the future.

Leave a comment below or share your thoughts with us on Facebook and Twitter.

Photo Credits: R.J. Matson, Cagle Cartoons