Spend Less Time and Effort to Make a Successful Budget with These Ready-made Templates and Cheat Sheets

You don’t need a finance degree or to spend hours crunching numbers just to create a budget and system that will help you curb spending, save money, and pay off debt.

Get the 10 resources in the Successful Budget Toolkit and master your money.

You’ve likely tried budgeting before and …

weren’t sure what should be in the budget

couldn’t stick with it

kept overspending

it took too much time

didn’t see an increase in saving

didn’t pay off more debt

Here’s some very common problems…

There wasn’t an actual budgeting strategy.

You picked a budgeting method that didn’t work for you.

You just slashed expenses instead of knowing how to analyze your budget to make successful changes.

You couldn’t stay motivated to budget.

Trying to figure everything out made you anxious.

You don’t want a PhD in Finance or to spend hours crunching numbers just to create a budget and system that will help you curb spending, save money, and pay off debt.

There is a much better way.

Templates and Cheat Sheets Included

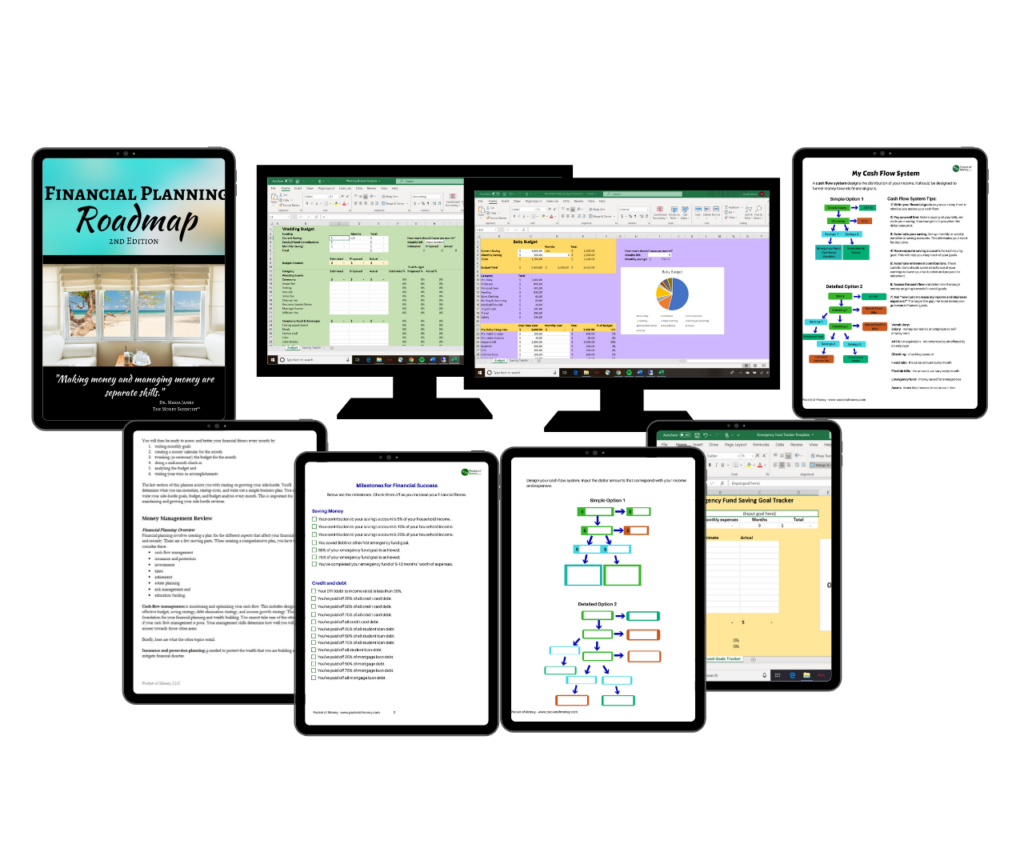

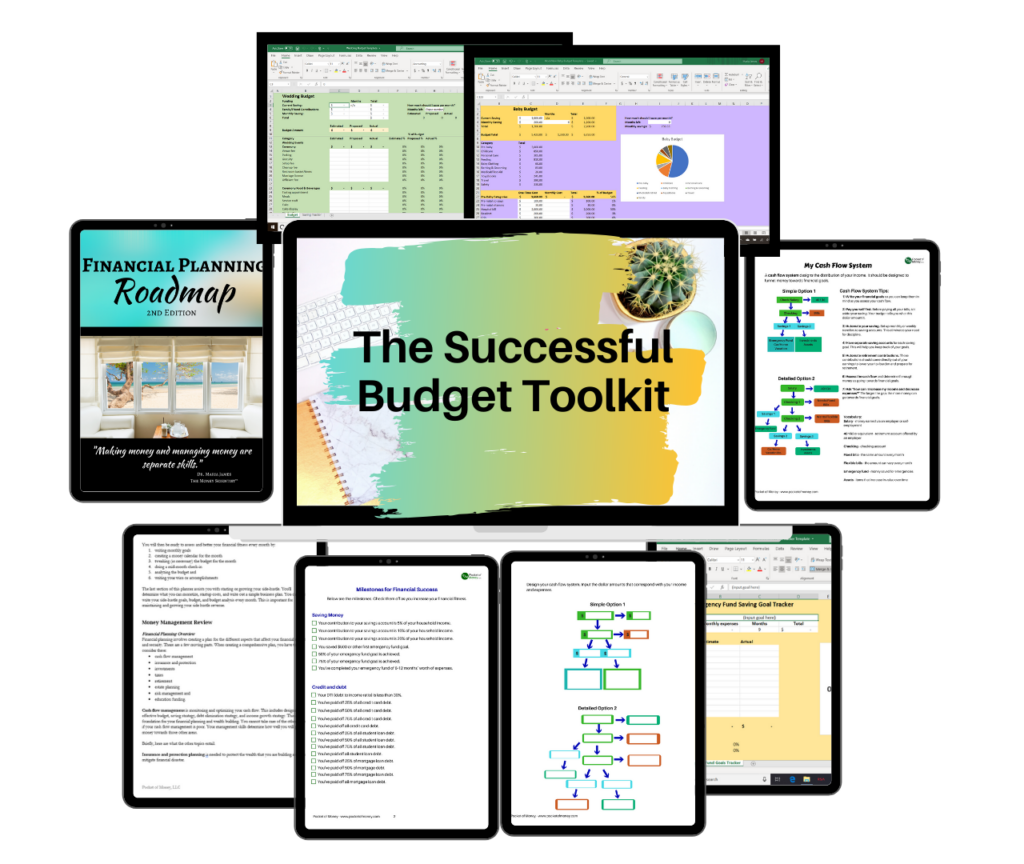

Digital Financial Planning Roadmap

Design an amazing budget and stay in action to reach financial goals.

Successfully budget every month, control your money, and prevent overspending. This 190 page planner explains 5 budgeting methods and 2 debt elimination methods.

There are 12 monthly budgeting worksheets to budget and track expenses by paycheck.

Cash Flow System Cheat Sheet

There are two potential cash flow systems that explain the exact accounts you need and how your money should flow.

Use this cheat sheet to get crystal clear on your income distribution to funnel money towards saving and investing.

Wedding Budget Template

All the major and minor categories and expenses are included into the budget. It’s a ready-made budget template of EVERYTHING you need to consider while planning for the big day.

Just plug-in your numbers and keep track of the estimated, proposed and actual amounts. You can also keep track of your saving progress.

New Baby Budget Template

The major and minor expenses that comes with having a new baby are included. There are pre-baby and post-baby expenses for the first year.

Just plug-in your numbers for one-time and monthly costs. You can also keep track of your saving progress before your bundle of joy arrives.

Vacation Budget Template

Budgets for staycations, getaways and international excursions are very different. The budget is a key part of the plan to make it a perfect trip. Plan for the expenses you may encounter with this template.

Use it to get clear on expenses pre, during and post trip. Save up your money before hand and track your progress.

Budgeting Goals Sheet

Get clear on how to reallocate money in your budget to achieve your goals. When it’s time to revise your budget don’t just slash numbers, use this sheet first.

Milestones for Financial Success Cheat Sheet

Know the milestones you need to achieve financial success. Covers financial stability and security. Track your progress and increasing financial fitness with this cheat sheet.

Saving Goals Tracker

Saving up for a new car, bed, tuition, house or other item? Using the planner and the resources, you will be saving more money. Track your progress with saving goals using this template.

Emergency Fund Saving Template

It is extremely tough saving up enough money to complete an emergency fund. Calculate how much you need in your fund. Keep the emergency fund tracker separate from other saving goals. Track your progress and stay motivated to complete it.

Stay Motivated Cheat Sheet

The journey to financial success as long and tough. Use these three proven methods to stay on track and motivated throughout the journey.

The Successful Budget Toolkit

With the Successful Budget Toolkit, you can pick the ultimate budgeting method for you and create a budget that will help you:

- Spend money guilt-free – because you planned your cash flow and know you have the money to spend. This removes the guilt and money stress.

- Enjoy the now while creating financial stability and security – because you deserve to enjoy the journey as you move towards financial success. Budgeting isn’t about restrictions, it’s about planning your income to achieve goals.

- Consistently save money and acquire and assets – Watch your savings grow as your able to consistently save money AND not withdraw it until you reach your saving goal.

- Maximize your current income for your goals and desired lifestyle – You will find more money to put towards goals on your current income. By cutting costs and not quality you will make sustained changes to reach your goals.

Create a budget that you will actually stick with and will allow you to save more money, stop overspending, payoff debt, and acquire more assets.

Who created the toolkit?

Dr. Maria James, The Money Scientist

Dr. Maria James, The Money Scientist is the founder of Pocket of Money and the creator of W.I.S.E. Financial Fitness. She has over 14 years of experience building and managing business and personal finance systems.

Dr. James took the critical thinking, analytical and strategy building skills she learned earning a PhD in Cellular and Molecular Medicine and applied it to finances. She saved over $10,000 on a stipend of $23,000 (after taxes).

She has built systems that help businesses make $1 million in 12 months. She has helped clients decrease overspending and save thousands of dollars per month.

“I founded Pocket of Money to help you take control of your money and live a world-class lifestyle. I am constantly studying business and finance and modifying the tools I create in order to be the most effective and useful. I want to empower you with the knowledge, tools, and skills you need to earn more and keep more money in your pocket to build wealth.” – Dr. James

As seen on

You Receive:

Digital Financial Planning Roadmap

Cash Flow System Cheat Sheet

Wedding Budget Template

New Baby Budget Template

Vacation Budget Template

Budgeting Goals Sheet

Milestones for Financial Success Cheat Sheet

Saving Goals Tracker

Emergency Fund Saving Template

Stay Motivated Cheat Sheet

Value = $122

Today’s price = $27